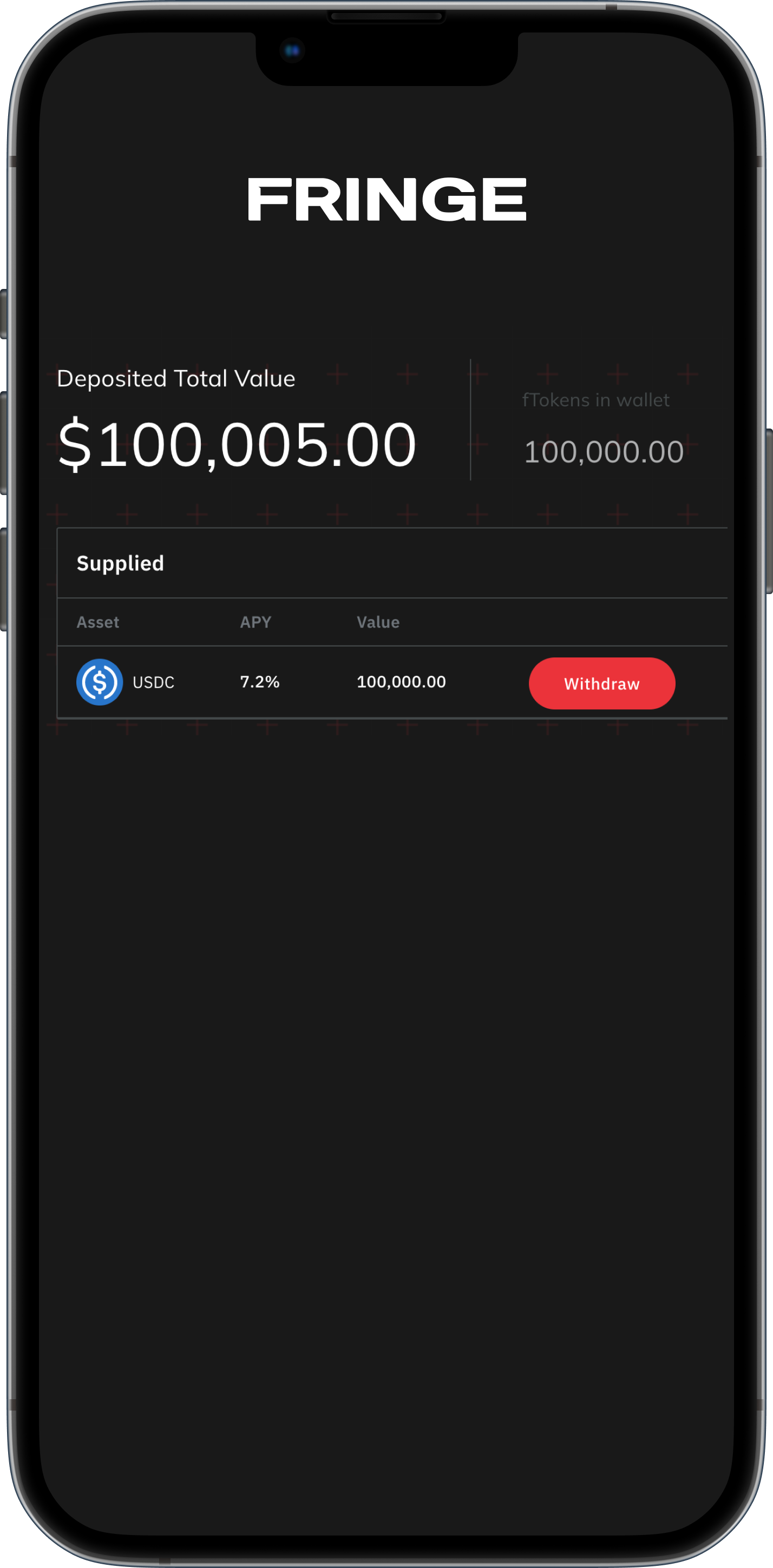

USDC Stablecoin Lending, up to 10% APY.

*Interest rate may vary

Maximize your USDC stablecoin holdings with Fringe Finance's low-risk Lending Platform.

Why Lend USDC on Fringe?

Simple to set up

The Primary Lending Platform offers a great opportunity to earn a stable, passive income with minimal time investment required.

Attractive rates

Decentralized finance often offers higher interest rates compared to traditional financial products.

Ride out Fluctuations

A low-risk way to earn a steady income without actively managing your USDC holdings and investments.

How are USDC Lending APYs generated?

1

Altcoin holders take a USDC stablecoin loan

Borrowers deposit collateral directly into the Primary Lending Platform to receive a Line of Credit. They can use their credit to borrow stablecoins.

2

Users pay interest on their USDC loans

Borrowers pay interest on their loans. The lenders' capital is protected because borrowers' positions are overcollateralized by default.

3

Interest is paid to lenders

Stablecoin Lenders earn an APY received from Borrowers' interest payments. Interest rates are dynamically adjusted to incentivize Platform activity.

How much USDC can I earn?

The Primary Lending Platform automatically adjusts the interest rate charged to Borrowers to incentivize Borrowers' and Lenders’ participation in the platform. The amount earned and APYs are based on the platforms' activity.

When there is high Borrower demand, the interest rate they pay will be algorithmically increased. This attracts more Lenders and capital to the platform. Lenders, in turn, receive a share of the greater interest charges collected from Borrowers.

When there is low Borrower demand, the interest rate they pay will be algorithmically decreased. The opportunity to take out loans with low interest attracts more Borrowers to the platform.

How safe are my USDC Loans?

Security is our top priority at Fringe Finance. We have undergone two independent audits by reputable entities. We are committed to protecting both lenders and borrowers by constantly reviewing and updating our platform's security parameters.

Smart Contract

Insurance (upcoming)

Insurance (upcoming)

Fully Audited By Two Major Security Firms

Lending Insurance

Vault (upcoming)

Vault (upcoming)

About Fringe Finance

FRINGE Finance is a decentralized financial ecosystem dedicated to unlocking the dormant capital from traditional financial markets and all-tier cryptocurrency assets. Fringe provides lending opportunities for stablecoin holders and collateralized loans for borrowers.